The Growth Of FSRU Market

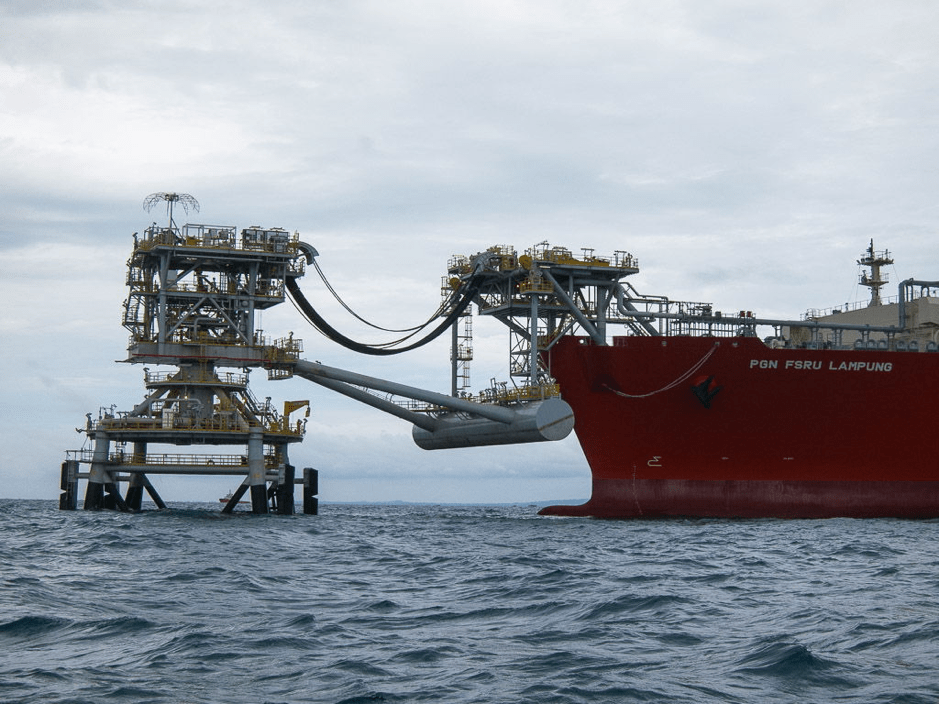

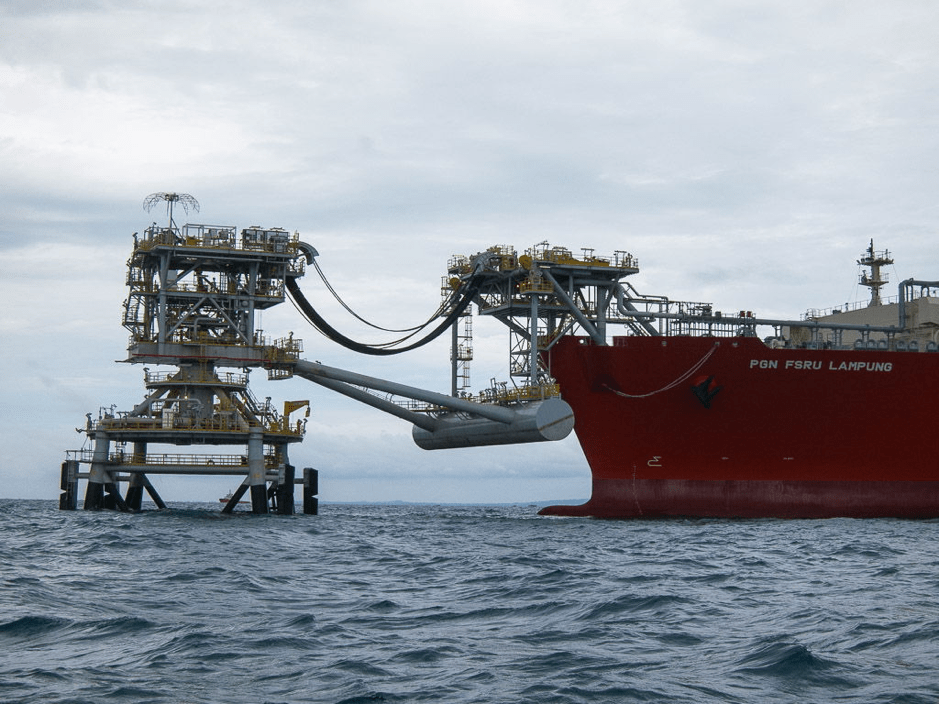

Floating Storage and Regasification Units (FSRUs) have been in operation for more than ten years. Over the years, it has successfully make its way from a specialist niche to being a main-stream solution for potential new regasification terminals. FSRUs have contributed greatly to the LNG industry by opening up new market opportunities to LNG and lower the barriers to entry into the industry.

As of January 2016, FRSU fleet has grown to more than 30 fleets. Imports through FSRU terminals have grown by 44% in 2015, to 22.8 million tonnes. Much of the growth was contributed by new terminals that set up in Pakistan, Egypt and Jordan.

The growth of FSRUs is largely driven by the move to cleaner fuels. The increasing usage of FSRUs has embedded several factors such as, the need to reutilise excess shipping capacity and the necessity to cater for seasonal gas demand. In countries such as China and Indonesia, the shift towards the use of FSRUs is driven by the need to diversify the energy mix ad switch away from crude and coal to cleaner fuels such as gas; FSRUs also offered the lowest cost and fastest option to effect the switch to gas when compared with other gas procurement option.

FSRUs run up to six times faster than onshore regasification terminals. Before deployment, they need to undergo a complex permitting regime, requiring a number of different licenses and permits relating to: –

- Environmental impact

- Management

- Marine operation

- Gas processing and trading

- Employment/social security of shipboard personnel

- General businesses or commercial licenses

- Many more…

Such requirements can cause delays of the FSRU, however, there are recent examples where FSRUs have been swiftly deployed. For instance, BW concluded a five-year FSRU charter with Egyptian Natural Gas Holding Company which operated on the basis of a five-month framework from project inception to first gas, a record short time for implementation.

In addition, contracting structures for FSRUs have changed remarkably since 2007. The contracting structures adopted in the early years were more conventional and rigid. In 2007, the market was characterised by long-term charters with a minimum of 10-15 years, took on a conventional and more rigid structure. Today, FSRUs are taking on a more flexible structure. Charter terms varies, there are shorter term charters in Middle Eastern countries, while some are still following the conventional structure.

The FSRU market has changed significantly over the decade. Looking ahead, the outlook of FSRU industry is set to be positive and demand will still increase.

Multi User FSRU LNG Terminal Use Agreement is a 2-day course that examines the commercial structuring of LNG import terminals and the special considerations for FSRU. Illustrated through case-studies, trainer will demonstrate how to effectively draft terminal use agreements including the associated documents for the relationship with Terminal Operator and between users, and many more. For more information, please visit us at http://www.opuskinetic.com/training or contact us at info@opuskinetic.com

Opus Kinetic believes that people are why organisations are successful, and giving people the knowledge to perform well at their job is integral for success. We pride ourselves as the premier provider of knowledge, offering acclaimed in-house training, leadership training courses, oil and gas training courses, courses that target health safety and environment, etc. Our training courses are well researched and updated with the latest industry trends. For more information on our professional training programs, you can visit us at http://www.opuskinetic.com/training.