What is the Contractual Structure of EPC Contracts?

Estimated reading time: 7 minutes

EPC (Engineering, Procurement and Construction) contracts is a common form of contracting agreement found in the Construction and Oil and Gas industry. The engineering and construction contractor will carry out the detailed engineering design of the project, procure all the equipment and materials necessary and lastly construct to deliver a functioning facility or asset to their clients. Companies that deliver EPC projects are commonly referred to as EPC contractors.

The reason why EPC contracts are popular is due to its features and the way it is structured such that both project owner and contractors mutually benefit from this agreement. It allows the project owner to manage risk more effectively and the contractors to allocate and specialise in the work they embark on. Under common EPC Contracts, the contractor has full control of the design, procurement, and construction of the project from inception to completion.

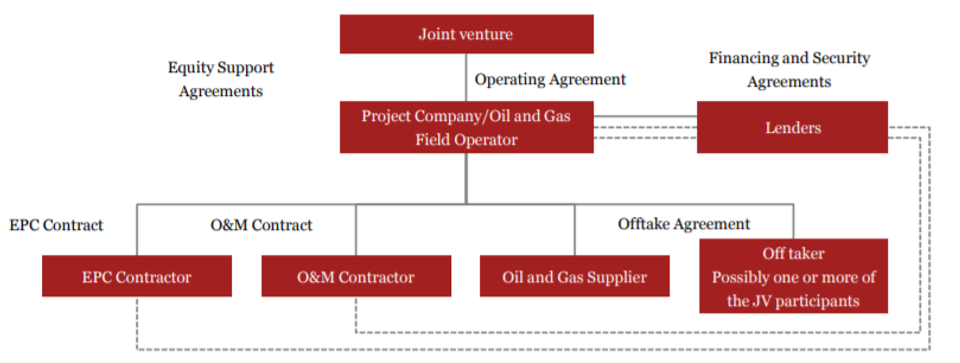

The contractual structure of EPC contracts varies from project to project. However, most projects will have the basic structure seen in the flow chart below. The operating company will usually enter into agreements which cover the following 5 elements in the contractual structure:

- Operating Agreement

- Choosing the Type of Contract

- Operating & Maintenance (O&M) Agreements

- Offtake Agreements

- Financing and Security Agreements

Source: PwC: EPC Contracts in the Oil and Gas Sector

- Operating Agreement

An operating agreement with the joint venture (JV) participants which gives the operating company the right to construct and operate the oil and gas facility. Usually, each joint venture participant will sell its own share of the product. Traditionally the operating agreement is a joint operating agreement between the JV participants whereby one of the participants operates the facility. There is a significant advantage in this structure as it means that one body is responsible for the delivery of projects, relationships with government, customers and contractors.

Most oil and gas companies have the ability to use corporate finance from the balance sheet, but there are a number of smaller oil and gas companies looking to develop assets that are regarded as stranded or too small for the larger companies to operate profitably. These companies require finance to carry out these developments. In these cases, the EPC Contractor must be a large, experienced participant in the industry which the sponsors and lenders are confident can successfully deliver the project and is large enough to cope with losses if it does not. The larger owners will still use an EPC Contract or design and construct contract for parts of large projects even if self-management, EPCM or other project management contracts are used for the balance of the project.

- Choosing the Type of Contract

There are a number of contractual approaches that can be taken to construct an oil and gas facility. For example, EPC Contract, supply contract, a design agreement and construction contract with or without a project management agreement. The choice of contracting approach will depend on a number of factors including the time available, the Lender’s requirements, the sophistication of the proponent, and the identity of the Contractor(s). The major advantage of the EPC Contract over the other possible approaches is that it provides for a single point of responsibility.

- O&M Agreements

Large overarching operating and maintenance agreements (O&M Agreements) are uncommon in the oil and gas industry. Industry participants are generally in the business of managing these facilities. However, components of the operations are usually contracted out.

- Offtake Agreements

Offtake agreements govern the sale of the product of the project. For gas projects and hydrocarbon derivative projects these agreements are crucial to the development proceeding. Financiers will not lend the funds and boards will not approve the project if there are no customers locked in to take the product. The impact of the offtake agreement is on practical completion. If there are take or pay agreements, it is vital that the project is ready to deliver product from inception date of the offtake agreement or it will face penalties.

- Financing and Security Agreements

Financing and security agreements with the Lenders to finance the development of the project.

The construction contract is only one of a suite of documents on an oil and gas project. Importantly, the promoter or the JV participants of the project operate and earn revenues under contracts other than the construction contract. Therefore, the construction contract must, where practical, be tailored so as to be consistent with the requirements of the other project documents. As a result, it is vital to properly manage the interfaces between the various types of agreements.

Managing International EPC Contracts for the Global Oil & Gas Industry is a 3-day training course held from 6 – 8 July 2020 (Kuala Lumpur). This course will furnish delegates with a thorough understanding of the key components and their interactions of an EPC contract and will address issues relative to dispute resolution. Know the importance of ‘scoping’ an EPC project correctly and have awareness of the key features and contractual provisions of an EPC contract. The focus is on open dialogue and collective problem solving relative to case examples and class exercises.

Unable to make it for the course? Contact us for other available dates.